Key man - Injuries

Protect your business from economic difficulties due to sudden absence of the key professional figures of your business.

We have developed a complete range of simple and modular insurance services and solutions, to meet the needs of every business.

Protect your business from economic difficulties due to sudden absence of the key professional figures of your business.

*Choose to have cover for both professional and extra-professional accidents, with guarantees covering death, permanent disability and more frequent minor injuries, and with indemnities and daily benefits for: temporary disability, convalescence, hospitalisation and bone fractures.

Promotional message, also of placement of insurance contracts. Before applying, please read the information at www.metlife.it and which is also available through the distribution network. MetLife Europe d.a.c. – General Agent for Italy policy distributed by Banca Ifis S.p.A

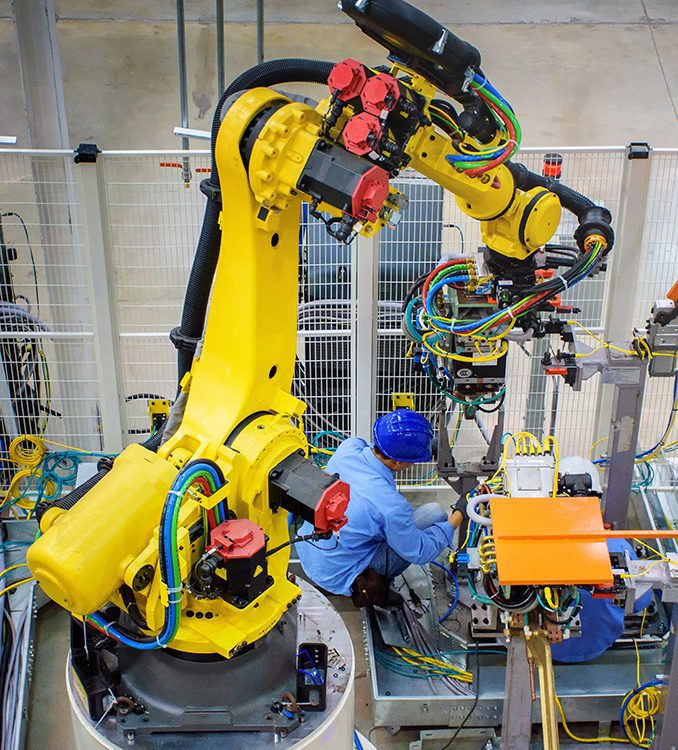

The policy responds to the obligation for companies to take out insurance contracts to cover damage to tangible fixed assets such as buildings and land (Building), plant, machinery and equipment (Contents), directly caused by natural disasters and catastrophic events introduced by Legge di Bilancio no. 213/2023.

Promotional message and placement of insurance contracts. Before subscribing, read the information set at www.netinsurance.it and in any case available from the distribution network. Policy of Net Insurance S.p.A. distributed by Banca Ifis S.p.A.

It is the complete insurance solution that repays your loan in case of contingencies.

CPI intervenes in the event of death, permanent disability and temporary disability caused by illness or accident involving the key people of your business and which can affect regular payment of instalments of the loan.

Promotional message, also of placement of insurance contracts. Before applying, please read the information at www.metlife.it and which is also available through the distribution network. MetLife Europe d.a.c. – General Agent for Italy policy distributed by Banca Ifis S.p.A

Choose this modular personal insurance solution, with cover in the event of Death, Permanent Total Disability and Temporary Total Disability due to Accident or Illness, to protect your residual lease fee repayments.

Protect leased instrumental assets with an insurance solution distributed by Banca Ifis, in collaboration with Generali Italia S.p.A., covering Theft and total and partial Accidental Damages that could be suffered.

Promotional message, for the purpose of placement of insurance contracts. Before subscribing, please read the key information set on: https://clp.partners.axa/it/ , or obtain a hardcopy from the distribution network. Insurance cover under the LEASE&LIFE policy is underwritten by carriers AXA FRANCE VIE S.A. and AXA FRANCE IARD S.A. (General Agent for Italy). Insurance products are distributed by Banca Ifis S.p.A.

Promotional message, also placing insurance contracts. Before signing, please read the information on www.generali.it and also available through the distribution network. Policy of Generali Italia S.p.A. distributed by Banca Ifis S.p.A.

Choose to protect your vehicle from accidental damage thanks to our modular insurance plans, offering Theft and Fire, Windshield, Vandalism, Weather Events, Breakdown and Collision or Kasko comprehensive insurance cover.

Choose to track your vehicle in the event of theft, thanks to a solution based on high-frequency wireless technology that helps you easily identify your car.

Choose the security of coverage that, in the event of total loss of your vehicle, through theft or irreparable damage, recognizes compensation equal to the difference between the vehicle’s purchase price and its commercial value at the time of the loss or any reimbursement value of your insurance.

Choose this modular personal insurance solution, with cover in the event of Death, Permanent Total Disability and Temporary Total Disability due to Accident or Illness, to protect your residual lease fee repayments.

Promotional message, for the purpose of placement of insurance contracts. Before subscribing, please read the key information set on: www.nobis.it , or obtain a hardcopy from the distribution network. The “Lease&Go” policy is underwritten by NOBIS COMPAGNIA DI ASSICURAZIONI S.p.A. and distributed by Banca Ifis S.p.A.

Promotional message, for the purpose of placement of insurance contracts. Before subscribing, please read the key information set on: https://clp.partners.axa/it/, or obtain a hardcopy from the distribution network. Insurance cover under the LEASE&LIFE policy is underwritten by carriers AXA FRANCE VIE S.A. and AXA FRANCE IARD S.A. (General Agent for Italy). The GAP+ policy is underwritten by AXA FRANCE IARD S.A. (General Agent for Italy). Insurance products are distributed by Banca Ifis S.p.A.

Write to sviluppoassicurazioni@bancaifis.it.