- Saving Account

- Current Account

- Leasing

- Technology Rental Ifis Rental Services

- Salary-backed Loan Capitalfin

- Business Plan 2022-2024

- Financial Performance and Presentations

- Financial Calendar

- Press releases

- Strategy and Strengths

- Ratings and debt programmes

- Share Information

-

FACTORING & SUPPLY CHAIN

- Factoring - Trade receivables

- Tax Receivables Purchasing

- Supply Chain Finance

-

LOANS

- Medium and long-term loans

-

LEASING & RENTAL

- Leasing

- Rental Ifis Rental Services

- Interruzione colonna

-

CORPORATE & INVESTMENT BANKING

- Financial Advisory/M&A

- Structured Finance

- Equity Investment

-

INTERNATIONAL

- Factoring import/export

- Import/export loans

- Other foreign banking services

- Interruzione colonna

-

BANKING SERVICES

- Current Account

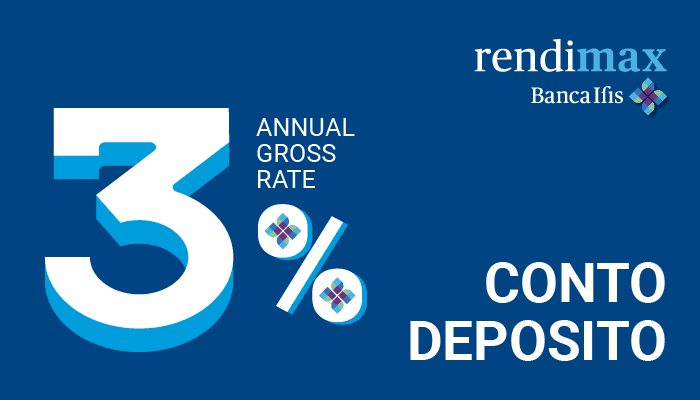

- Time Deposit

-

OTHER SERVICES

- Insurance

-

Highlight Find out more

- Mission, Vision and Values

- Our Story

- Management

- Interruzione colonna

- Bank’s Business Model

- Presence in Italy and abroad

- Structure of the Group

- Interruzione colonna

- Awards and acknowledgments

- Digital Transformation

- Interruzione colonna

- Interruzione colonna

-

Companies of the Banca Ifis Group

- Banca Ifis

- Banca Credifarma

- Cap.Ital.Fin.

- Interruzione colonna

-

- Ifis Npl Investing

- Ifis Npl Servicing

- Interruzione colonna

-

- Ifis Rental Services

- Ifis Finance I.F.N. S.A.

- Ifis Finance Sp. Z o.o.

-

BUSINESS AREAS OF THE GROUP

- Services for businesses and individuals

- Purchase and management of non-performing loans

- Corporate Governance at-a-glance

- Corporate Bodies

- Shareholders’ meeting

- Interruzione colonna

- Internal control system and risk management

- Auditing

- Shareholders

- Internal Dealing

- Remuneration

- Interruzione colonna

- The Value of Ethics

- Interruzione colonna

- Reports and Documents

-

IMPACT

- The Ecosystem of Cycling

- Ifis sport

- Market Watch

- Interruzione colonna

-

BUSINESS

- PMIheroes

- What our experts say

- Vacancies

- Who we are looking for

- Experience gained

- Recruitment process

- Interruzione colonna

- Get to know Banca Ifis

- Interruzione colonna

- General application